The best way to form an LLC for the majority of our readers is Incfile because of its low price and straightforward process. Register your LLC in any state starting at $0 plus state fees.

Limited liability companies (LLCs) are a popular option for entrepreneurs nationwide. Unlike other types of business structures, LLCs can be formed in any state, regardless of your company’s physical presence.

Some states offer significant financial advantages compared to others. This guide will take a closer look at the best states to form an LLC and ultimately help you determine the best state of formation for your business.

Foreign LLCs vs. Domestic LLCs

If you form an LLC in your state of residence (your home state), it’s known as a domestic LLC.

When you form an LLC somewhere other than your home state, you’re required to register that business as a foreign LLC in your home state. To be clear, the term “foreign” has nothing to do with a business being owned by a non-US resident or outside the US. It just means that the company is doing business outside of its home state.

Why is this important?

Starting an LLC in another state might require you to form two LLCs—one in the state of formation and another in your home state.

For example, let’s say you live in Indiana but want to form an LLC in Wisconsin. You’d have to register that company as a foreign LLC in Indiana to do business in your home state.

With two LLCs, you’ll have double everything. That includes two state filing fees, registered agents in both states, two annual reporting fees, and more.

Maintaining two LLCs can quickly double your costs and double your headaches.

You can dive deeper into the differences between foreign and domestic LLCs, to determine which is right for you. And if you’re not sure whether an LLC is right for your business right now, we’ve outlined the differences between an LLC and sole proprietorship and DBA vs. LLC to explain things.

Forming an LLC in Your Home State

Are some states better to form an LLC than others? Absolutely.

But for the vast majority of people, registering an LLC in your home state will be the best option.

Most people hear or read something online that says, “Nevada has no corporate income taxes,” and assume it’s the right state to form a business. While the former may be true, the latter is not always the case—especially for anyone who lives outside of Nevada. (We’ll talk about Nevada in greater detail shortly).

Why? Remember, you’ll still be required to register a foreign LLC in your home state. So, you’ll still have to pay taxes in your home state, on top of the additional fees required for maintaining two LLCs.

The idea that you can form your LLC in a “no-tax” state, elect to be taxed as a corporation, and not pay income taxes in your home state is essentially misinformation. For most people, your home state will always be the best place to form your LLC. It’s unlikely you’ll be able to save money by registering an LLC elsewhere, and it will likely cost you more money in both the short-term and long-term.

Whether you choose to form an LLC in your home state or in one of the states on this list, we recommend using an LLC formation service to help you get started. You can read our full reviews of the best LLC services here.

5 Best States to Start an LLC

With all of that in mind, five states stand out amongst the rest as the best locations to form an LLC, so if you live in one of these states—great.

If you don’t live in one of these states, don’t automatically think it’s a good idea to form an LLC here (for the reasons discussed above). The type of business you’re starting will be a factor, as well. For example, an online-only consulting business with no physical facilities or storefronts could consider forming an LLC outside of their home state. But a retailer with a physical storefront in a shopping center probably wouldn’t have as much flexibility.

Below we’ll dive deep into the pros and cons of forming an LLC in the “best” states.

1. Delaware

Delaware has a longstanding reputation for being one of the most business-friendly states in the nation. According to the Delaware Division of Corporations, nearly 67% of Fortune 500 businesses are incorporated there.

While this doesn’t necessarily apply to LLCs, it definitely conveys a draw for organizations to form a business in Delaware. In 2021, 247,003 LLCs and 24,588 LPs/LLPs (limited liability partnership) formed in Delaware compared to 62,510 corporations.

Why?

For starters, the initial state filing fees and franchise taxes are lower than other states. Delaware doesn’t impose taxes on out-of-state income, either. The filing process is simple and allows LLCs to get up and running quickly. The state keeps it easy after that, too, with online filing of LLC taxes and reports.

Another unique standout of Delaware is the Chancery Court. This is one of three constitutional courts in Delaware (alongside the Supreme Court and Superior Court).

The Chancery Court is only for business cases. This means that business-related cases are resolved much quicker than in courts that hear cases in all categories. Plus, the judges in the Chancey Court have much more experience in business hearings.

Delaware doesn’t require shareholders, directors, or officers to be residents of the state. Furthermore, one person can be named in all of these roles. It’s also one of the only states that allows you to exclude your personal identity from the formation documents.

Pros of Forming an LLC in Delaware:

- Quick and simple formation process

- Low filing fees and franchise taxes

- No corporate income taxes (foreign LLCs that elect for corporation taxing)

- More privacy for your business

- Flexible business structure

- Specialized business legal system (Chancery Court)

Cons of Forming an LLC in Delaware:

- Dual-registration required for out-of-state LLCs

- Two registered agents required (one for each state)

- Multiple legal representatives (most lawyers are only licensed in one state)

- No flat franchise taxes

If you live outside of Delaware and want to form an LLC there, it could ultimately be more expensive than starting an LLC in your home state. Aside from having to maintain two LLCs, your administrative costs may also be higher. An accountant in your home state may not be familiar with Delaware structures, so you’d likely have to retain two accountants.

Need help? Visit Incfile to form an LLC in Delaware today.

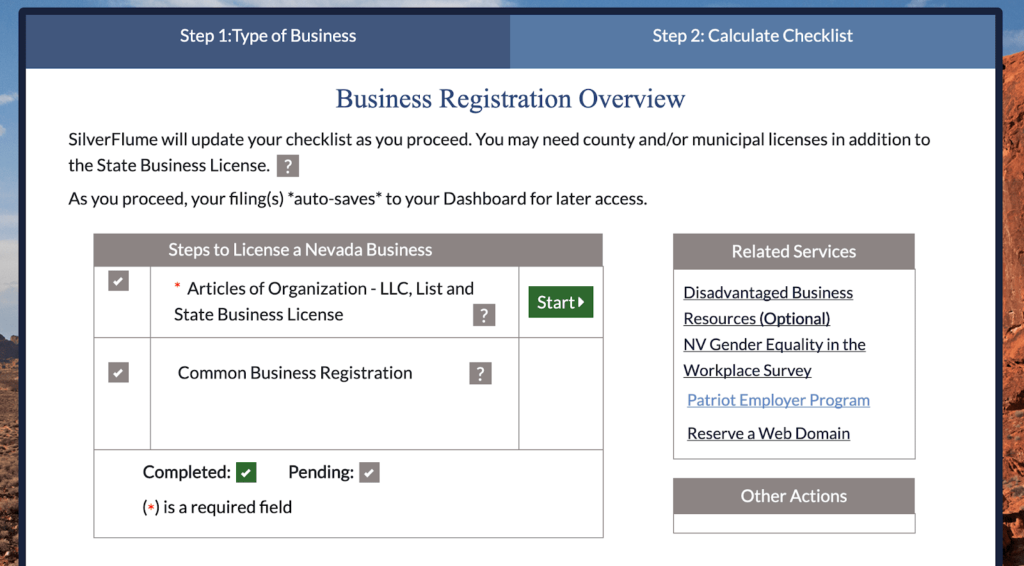

2. Nevada

Nevada is another state that draws a lot of attention from business owners who want to avoid paying high taxes. That’s because Nevada doesn’t impose taxes on personal income, corporate income, or franchise taxes.

With that said, Nevada does require business owners to pay annual license fees and annual filing fees.

In terms of privacy, Nevada is arguably second to none. They are one of the only states that allow for complete anonymity with public filings. In short, your LLC can remain anonymous in any public registration filing.

Furthermore, Nevada does not have an information-sharing agreement with the IRS. Since the state doesn’t have an income tax department, there’s no information to share.

Maintaining an LLC in Nevada is easy since they don’t require annual meetings or operating agreements.

The registration process is simple and also requires fewer steps compared to other states nationwide.

Pros of Forming an LLC in Nevada:

- No state personal income or corporate taxes

- No franchise taxes

- LLC owners can remain anonymous

- No information-sharing agreement with IRS

- No operating agreements or annual meetings required

Cons of Forming an LLC in Nevada:

- Annual business license fees

- Annual filing fees

- List of officers and directors is public information

- Gross earnings over $4 million may be subject to taxes

As you can see, forming an LLC in Nevada isn’t always ideal, especially if you’re in another state. You’ll still have to create a foreign LLC in your home state and maintain two registered agents for each LLC.

Need help? Visit Incfile to form an LLC in Nevada today.

3. Wyoming

Wyoming is another state with policies aiming to be as business-friendly as possible. For starters, they don’t impose strict reporting obligations for business owners.

Similar to other states on our list, Wyoming doesn’t tax personal income or corporate income. There aren’t any franchise taxes either.

Wyoming offers something really unique compared to other states—a lifetime proxy. With a lifetime proxy, you’re able to appoint another person to represent your shares or stock in a company on your behalf. This means that business owners in Wyoming can benefit from complete anonymity.

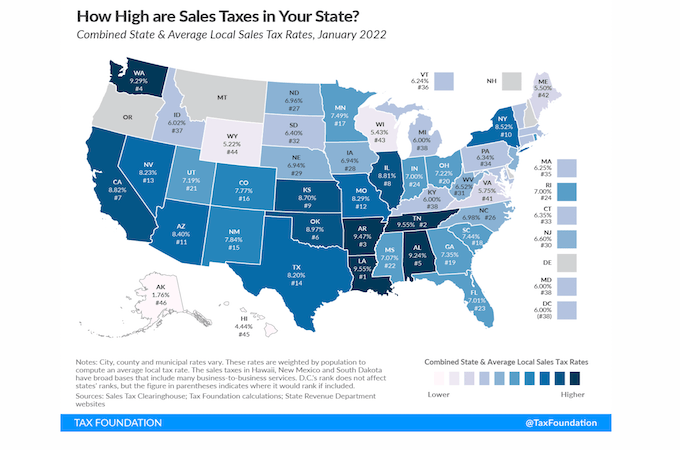

Aside from no individual or corporate taxes, the sales tax rates in Wyoming are very low.

As you can see from this graph, Wyoming ranks 44th in the country for local tax rates. Of the 46 states that impose sales tax (four states don’t have any sales tax), Hawaii and Alaska are the only two with lower averages.

Pros of Forming an LLC in Wyoming:

- No franchise taxes

- No corporate or personal income taxes

- Low sales tax rates

- Minimal reporting requirements for LLC owners

- Lifetime proxy (for owner anonymity)

Cons of Forming an LLC in Wyoming:

- LLC dissolution (if a member dies or files for bankruptcy)

- High administrative costs

- Asset protection is not guaranteed for lawsuits outside of Wyoming

Wyoming is definitely a great state to form an LLC for entrepreneurs who live in the state. But do the pros outweigh the cons if you’re living elsewhere? Your home state will still require a foreign LLC registration, so you can’t avoid taxation altogether.

Need help? Visit Incfile to form an LLC in Wyoming today.

4. Alaska

Alaska—the last frontier. While Alaska is best known for its cold weather and thousands of miles of uninhabitable terrain, it’s also a top location to form a business.

The largest state in the Union (and one of the last to join), it is an appealing place to start an LLC.

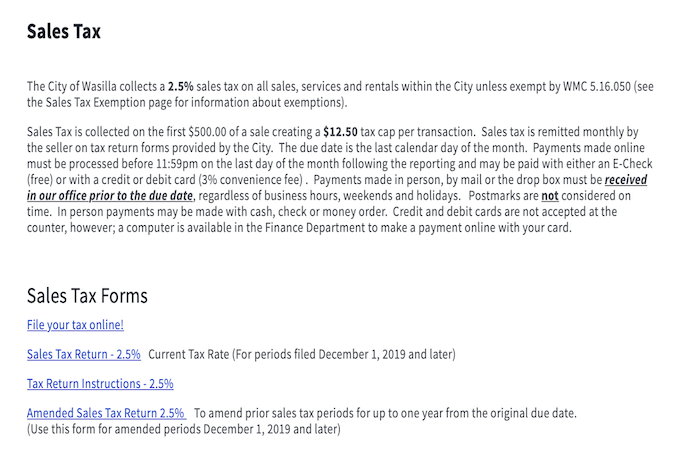

For starters, there is no state income tax or sales tax in Alaska. However, it’s worth noting that cities can collect local sales taxes (although these are generally low).

Depending on your new business’s industry, you might be entitled to certain tax credits as well. Examples include film production credits, frontier basin credits, new area development credits, qualified oil and gas service industry expenditure credits, minerals exploration incentives, and more. However, most of these require you to actually do business within the state.

Alaska also provides new business owners with great loan programs. In October 2022, the State of Alaska, alongside the University of Alaska and the Alaska Small Business Development Center, announced the launch of a new financing program with $59.9 million in funding. These funds will be available to Alaska small businesses over the next ten years.

But similar to the tax credits, they are intended for businesses operating with a physical presence in Alaska.

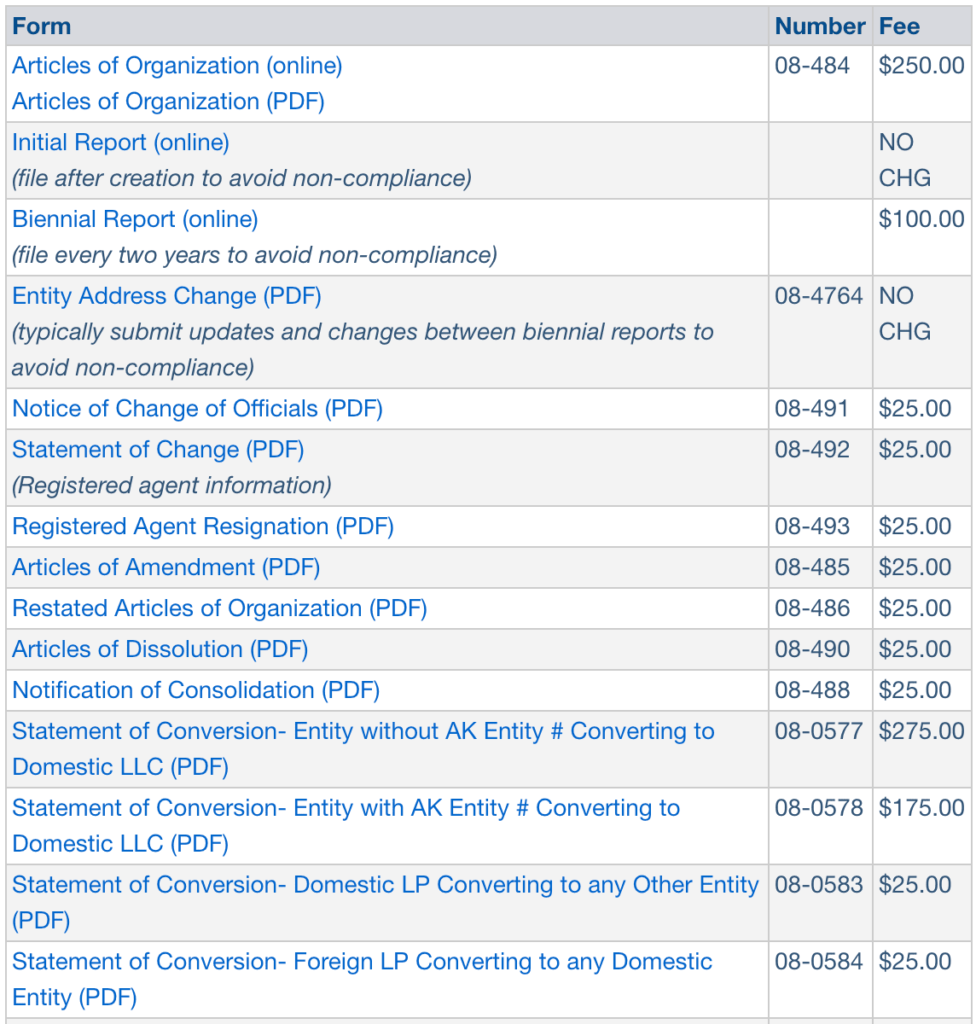

The state fees associated with forming an LLC in Alaska are fairly inexpensive compared to other states. Here’s a list of some common LLC fees from the Alaska Department of Commerce, Community, and Economic Development website:

Pros of Forming an LLC in Alaska:

- No state income taxes

- No state sales taxes

- Low local tax rates

- Low LLC filing fees

- A lot of tax credits and loan opportunities

Cons of Forming an LLC in Alaska:

- Most credits are for businesses actually operating within Alaska

- Local jurisdictions can collect sales tax

- Physically distant from other states

If you live in Alaska and your business operates in Alaska, it’s definitely a great place to form an LLC. But it’s not always a practical solution for out-of-state LLC owners.

Need help? Visit Incfile to form an LLC in Alaska today.

5. South Dakota

Like other states on our list, South Dakota does not have any state income taxes (a common theme on our list).

Another advantage of starting a business in South Dakota is its 0% corporate tax rate. So, this is a great option for creating an LLC that gets taxed as a corporation. South Dakota has several other tax advantages as well, including no personal property taxes, no inheritance tax, and no business inventory tax.

The filing process is easy, affordable, and can be completed online without strict requirements.

Pros of Forming an LLC in South Dakota:

- No state income taxes

- 0% corporate tax rates (for LLCs taxed as corporations)

- No business inventory tax

- Other tax advantages (for people living in South Dakota)

Cons of Forming an LLC in South Dakota:

- Limited life

- Local registered agent required

Most of the advantages associated with forming an LLC in South Dakota are for state residents and companies operating within the state. Anyone else would still have to maintain a foreign LLC in their home state.

Need help? Visit Incfile to form an LLC in South Dakota today.

What to Expect When You File For an LLC

Regardless of your state of formation, there are certain expectations for LLC filing that remain constant across the board.

First, expect to pay some type of filing fee to the state. These typically range anywhere from $50 to $500, and payments are due upon filing your Articles of Organization.

Many states also require you to file an Operating Agreement. This is a legal document that explains how your LLC will be run and managed. Even if your state doesn’t require you to file an Operating Agreement during the formation process, it’s still in your best interest to do so, as it will help prevent internal conflicts amongst LLC members.

Be prepared to appoint a registered agent during the filing process as well. You could technically name yourself as the registered agent, but it will make your life much easier if you use a professional registered agent service.

Once everything has been filed, it’s just a matter of waiting until the state officially recognizes your LLC as a legal entity. The exact time varies by state, but the typical range is anywhere from three to ten business days. Most states let you expedite your filing for an additional fee, which can also be facilitated through your business formation service.

Best States to Form an LLC: Your Top Questions Answered

Conclusion

LLC formation is not universal from state to state. As you can see from this guide, some states have advantages compared to others for LLC owners.

With that said, it doesn’t mean that you should automatically form an LLC in one of these states.

So, while you may get tax breaks in one state, you’ll still have to pay them in your home state. Plus, maintaining two LLCs comes with its fair share of headaches, like extra fees, multiple accountants, multiple lawyers, and multiple registered agents.

In most cases, the pros won’t outweigh the cons when it comes to forming an LLC in a state other than your own. As always, consult with your accountant and attorney before deciding where to form an LLC.