Getting caught up in turning a profit at the expense of managing cash flow is all too easy for small business owners. Consider that 82 percent of small businesses fail because of cash flow-related issues. Furthermore, 84 percent of small businesses are not profitable until the fourth year, so you can see that your business’s cash flow should be a primary focus.

So, what do you do if you cannot qualify for a traditional personal or business loan to bolster your business?

For many entrepreneurs today, merchant cash advances offer a vital lifeline in an otherwise murky landscape. Alternative financing can be a viable solution if you need money quickly and with few qualification criteria. We have put together a list of the eight best merchant cash advance services you might consider for your business.

The Top 8 Best Merchant Cash Advance Services

- Fundbox – Best For New Business

- PayPal Working Capital – Best For High Volume PayPal Sales

- National Business Capital – Best For Large Loans

- National Funding – Best For Long-Term Financing

- Can Capital – Best For Bad Credit

- Stripe Capital – Best For High Volume Stripe Sales

- Reliant Funding – Best For Quick Funding

- Main Street Finance Group – Best For Consolidating MCAs

Read on to see our reviews of the top eight merchant cash advance services and learn how a cash advance works and how to choose the best one for your needs.

#1. Fundbox – Best Merchant Cash Advance For Startups

- Good for entrepreneurs and startups

- Borrow as little as $1,000

- Up to $50,000 without collateral

- Credit score of at least 500

Most merchant cash advance services target relatively established businesses, making it difficult for new business owners to qualify. Fundbox has some of the lowest requirements to be eligible for a business line of credit.

You can borrow as little as $1000, which is perfect for solving day-to-day petty cash shortfalls quickly. You can also borrow up to $50,000 without collateral or a personal guarantee. However, you will need to provide a personal guarantee and blanket lien for amounts exceeding $50,000. The maximum amount for borrowing is $150,000 with Fundbox.

Fundbox’s credit score requirements are also low and easy for small businesses to qualify. You only need a credit score of at least 500 and at least three months in business.

Accounting software also integrates with Fundbox to make the application process painless. Fundbox syncs with the most popular accounting software, including QuickBooks, FreshBooks, Jobber, Xero, Clio, Harvest, Zoho, eBility, and Jobber. As long as your accounting software reflects at least three months’ transaction history and $5000 or more in monthly revenue, you have a good chance of qualifying.

You can also link your checking account, but you will need at least six months of credit card transactions in your business account. Fundbox can be flexible with its requirements, particularly if you have high monthly revenue.

The application process is mostly automated with minimal paperwork. Most applicants receive a verdict within minutes, and the money can be available in as little as a day.

While Fundbox has all the MCA features tailored for small businesses and startups, the fees can be a little high. The APR ranges between 10.1% and 79.9%, depending on your terms. Some people may also find the 12-24 week repayment period a little short.

Overall, if you are happy with the fees, Fundbox is one of the most forgiving merchant cash advances (more accurately, a business line of credit) out there for startups with its low requirements.

#2. PayPal Working Capital – Best Merchant Cash Advance For High Volume PayPal Sales

- Financing based on PayPal history

- Repayment between 10%-30%

- Borrow up to $20,000

- Minimum $1,000

If you primarily accept PayPal payments, qualifying for a merchant cash advance can be a little tricky. Most institutions only allow you to link your bank account or accounting software to determine your eligibility.

This financing option bases your eligibility on your PayPal account history. You don’t have to worry about your credit score or a hard check that may affect your score.

The qualification criteria are also relatively accessible. You need a PayPal Business account or Premier PayPal account with at least three months of transaction history. Additionally, you need annual sales exceeding $15,000 for the Business account and $20,000 for the Premier account.

It’s also hard to beat PayPal Working Capital’s speed. You get your verdict in just a few minutes, and the funds are made available in your PayPal account almost immediately after approval.

Repayments work on a percentage basis. You choose what percentage of your daily sales go towards repaying the advance. The repayment ranges between 10 and 30 percent, with lower fees applied for higher repayments. The only catch is that you have to pay back the amount plus fees within 18 months. PayPal Working Capital reports that most borrowers clear their loan in one year.

You can borrow up to $20,000 with a minimum of $1000. The repayment is also transparent, and you know exactly how much you will be paying back, with no hidden fees.

PayPal Working Capital is technically a business loan and is perfect for PayPal merchants with a good track record of PayPal sales. This is true if you are comfortable with the factor rate of between 1.01 and 1.58.

#3. National Business Capital & Services – Best Merchant Cash Advance For Large Loans

- Borrow between $10,000 and $5mm

- Franchise & comm. mortgage financing

- Need at least 6 months in business

- Receive funds in 1-3 business days

National Business Capital & Services isn’t a direct lender but connects applicants with over 75 lender partners. The institution boasts a 90% approval rate for small businesses, which is believable given its vast lender network.

First off, NBC offers a wide range of products, including merchant cash advances, invoice financing, franchise financing, commercial mortgage financing, online small business loans, and business lines of credit.

You can borrow between $10,000 and $5 million, depending on how much you qualify for. Repayment is based on a percentage of daily sales.

The requirements also aren’t too bad for seasoned businesses with high revenue. You need at least six months in business and $120,000 in annual gross sales. National Business Capital & Services also claims to work with all kinds of credit profiles and will most likely not run a credit check as long as you meet the requirements. In the instances where National Business Capital & Services does a credit check, it is a soft pull that will not hurt your credit score.

Additionally, you don’t need to put down collateral, especially for the lower amounts. You receive the funds in 1-3 business days after your application is approved.

You have to fill out an application to receive a personalized quote.

#4. National Funding – Best Merchant Cash Advance For Long-Term Financing

- Great for small businesses

- Rewards loyalty and on-time payments

- Borrow between $5,000-$50,000

- Credit score of at least 500

If you are looking for a long-term merchant cash advance partner for your small business, you can hardly do better than National funding. Their service is described as a working capital loan but is indistinguishable from a merchant cash advance. The company also offers equipment financing should you need to weigh your financing options.

National Funding rewards loyalty and customers who pay on time. For example, you can get an extension on your first capital loan as soon as you pay off 50% of the loan. Unlike most other MCAs, National Funding rewards rather than penalize you for repaying your loan early. You automatically get 7% off your total remaining balance if you repay the loan within the first 100 days.

You can borrow between $5000 – $ 500,000, which is a good range for most small to medium-sized businesses. Additionally, you qualify for better future loan rates if you keep your account in good standing by repaying on time or early.

Loan terms vary between one and five years. Again, you can qualify for more extended periods by keeping your account in good standing. You also don’t need collateral or a personal guarantee for funding below $250,000. However, you will be required to file a blanket lien over your business assets if you borrow more than $250,000.

To qualify, you will need at least three months’ worth of bank statements and a credit score of at least 500. Factor rates start from 1.17 per week, but you will have to sign up before accessing the actual rate. This design makes it difficult to price shop, and a rate calculator would have been handy. Still, you are not obligated to agree to the terms should you find the rate too high for your liking.

#5. Can Capital – Best Merchant Cash Advance For Bad Credit

- Good for owners with poor credit

- Borrow between $2,500 & $250,000

- Payment schedule based on sales

- Daily automatic ACH deductions

The main attraction for alternative funding is the accessibility of financing, particularly if you have poor credit. Can Capital has over 20 years of experience and has served more than 80,000 businesses with over $7 billion in funding.

You can access between $2500 and $250,000, which is a decent range, particularly for startups. The qualifications are also reasonably easy to meet and include at least six months in business and gross revenue of $150,000.

The kicker, and what makes Can Capital so attractive to business owners with poor credit, is that there is no minimum credit score required. The underwriting process heavily relies on your gross revenue, which works out well if you meet the $150,000+ threshold.

Furthermore, Can Capital can finance business owners with a history of personal or business bankruptcy, as long as it has been at least one year since you obtained a discharge.

You will need to pay an origination fee of $595 to process your merchant cash advance. Although the financer does not have a minimum credit score requirement, they may sometimes perform a hard credit pull. Can Capital may also file a blanket UCC lien on your business assets, particularly for significant advances.

Finally, your payment schedule is based on your credit and debit card sales. You set up daily automatic ACH deductions based on the agreed-upon factor rate.

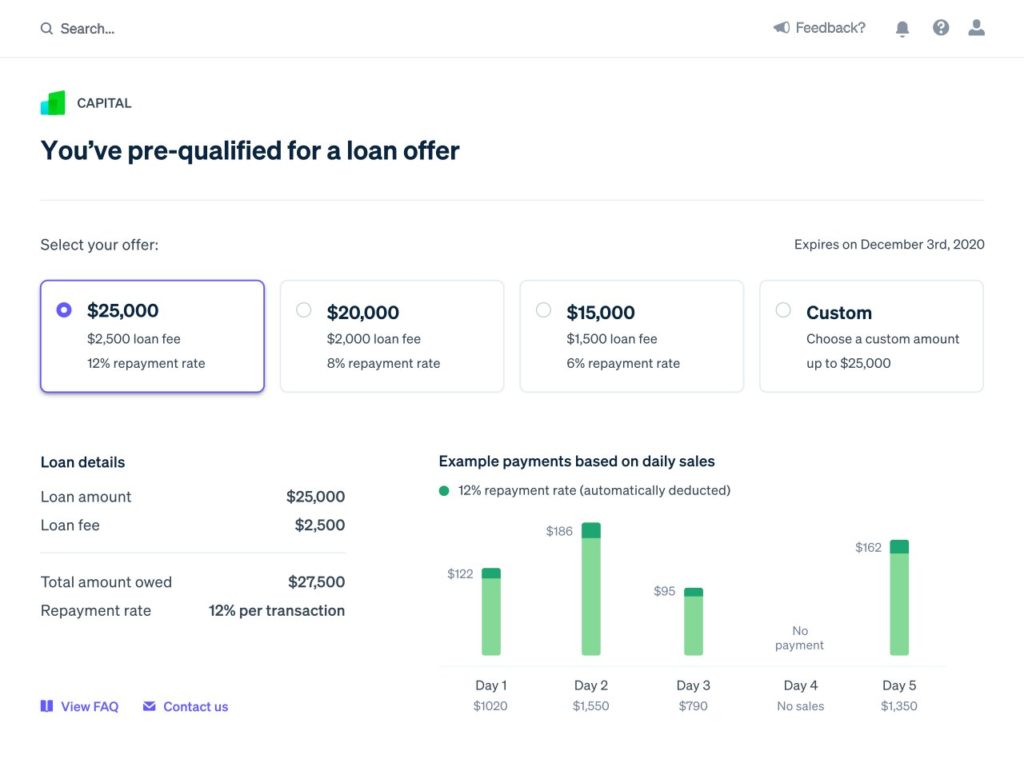

#6. Stripe Capital – Best Merchant Cash Advance For High Volume Stripe Sales

- Great for Stripe users

- Takes % of daily sales as payment

- Qualify for up to $25,000

- Need 12 months of Stripe history

If you primarily use Stripe for your business, there is no need to set up a different business account or link your accounting software. Stripe Capital also has no minimum credit score requirements. The financer only considers your Stripe history when making a final verdict.

You can check your eligibility before you sign up for the advance. Simply enter the required information, and Stripe will let you know if you are eligible for an offer. Typically, Stripe will send you three offers to choose from, with the additional option of customizing your loan amount.

Strip Capital takes out a pre-agreed upon percentage of your daily sales until you clear the advance. The maximum loan term is 18 months, and you can qualify for up to $25 000. Your repayment rate depends on the amount advanced. There is also a standard loan fee of 10% of the loan amount.

You need at least 12 months history of using Stripe to qualify, and you can receive funding in as little as 24 hours after you are eligible.

#7. Reliant Funding – Best Merchant Cash Advance For Quick Funding

- Fast funding

- Good for emergencies

- Revenue of at least $100,000 needed

- Finance up to $250,000

If you need cash for an emergency, Reliant Funding offers same-day funding if you qualify for an advance. The three-step application process is quick and easy, and you will get a final verdict within hours of applying. The longest you will typically have to wait for funding is the next day.

In addition to merchant cash advances, Reliant Funding offers additional services, including lines of credit, equipment financing, and short-term business loans.

Reliant Funding does not have a minimum credit score requirement. This financer focuses more on your sales track record. You will need to have been in business for at least a year and have annual revenue of at least $100,000. Reliant Funding is also flexible and may agree to advance funds if you have been in business for six months but have higher-than-average monthly revenue.

The maximum financing amount is $250,000 with a 12-month maximum term. Like your typical merchant cash advance, Reliant Funding takes out a percentage of your daily sales until you clear the advance.

Unfortunately, there is no way to know the factor rate until you apply for the advance. They offer customized repayment terms based on their assessment of your finances and the amount you require.

If you have good standing, you can renew your funding after paying off 50% of your advance. You can choose to pay off the funds in one of two ways: Either pay a fixed percentage of your credit card revenue or ACH debits from your checking account.

#8. Main Street Finance Group – Best Merchant Cash Advance For Consolidating MCAs

- Large MCA for preexisting advances

- Merchant cash advances

- Healthcare cash advances

- Great for consolidation

It is notoriously easy to get into a debt cycle with merchant cash advances. Although we don’t advocate for stacking debt, sometimes, this is the only recourse when faced with chronic cash flow problems.

An easier way than stacking loans is to consolidate your advances with one lender, and Main Street Financing Group fits the bill. The lender offers a large MCA to cover your preexisting advances so you can focus on paying off a single debt. While you can expect the factor rate to be higher than applying for a new advance, it is still cheaper than the total cost of repaying many different cash advances. You will need to apply for debt consolidation to get your personalized repayment rate.

Main Street Finance Group also offers other services, including merchant cash advance, healthcare cash advance, equipment financing, credit lines, and collateral loans.

How Merchant Cash Advance Works

A merchant cash advance is unlike a traditional business loan. Essentially, the lender offers you lump-sum cash upfront in exchange for a percentage of your future sales.

The lender takes a pre-agreed upon percentage of your daily or weekly credit card sales until the total amount is repaid. This repayment structure means that you don’t technically have a set repayment term, although lenders typically impose a maximum repayment term. Payments are automated and generally made on a daily or weekly basis.

Rather than a standard interest rate, you instead get a factor rate, which determines the exact amount you pay back. You multiply the factor rate by the cash advance amount to find the total amount to pay back. For example, if you borrow $100,000 at a factor rate of 1.25, the total repayment will be $125,000 ($100,000 x 1.25).

Essentially, the more sales you make, the more money you pay back each day or week. The reverse is also true. Also, the lender will typically calculate an estimated repayment period based on your sales history.

Some of the criteria that lenders use to determine your factor rate include average monthly revenue, how long you have been in business, seasonality of the company, and revenue consistency.

Another term to be familiar with is the holdback rate. This is different from your factor rate. While the factor rate relates to the total amount you pay back, the holdback rate refers to the day-to-day payments you make towards your advance.

The holdback is expressed as a percentage and is the amount of money taken out of each day’s or week’s transactions. For example, if you get a holdback rate of 10 percent and you make credit card sales worth $8000, you will be paying back $800 on this day. If you make sales worth $5000 tomorrow, your lender automatically takes $500, and so on.

How to Find The Best Merchant Cash Advance Service

Merchant cash advance services have often been accused of being predatory. Since merchant cash advances aren’t technically loans, these companies are not subject to state usury laws.

On a more positive note, stiff competition means that the factor rates have improved over time. Still, there are a few factors that you need to keep in mind when shopping for a merchant cash advance service. We used these same criteria when picking contenders for our best merchant cash advance review.

Rates & Fees

Generally speaking, merchant cash advances are more expensive than traditional loans and other financing options, so you really want to pay attention to the rates and fees.

Watch out for the factor rate. This rate ranges between 1.14 and 1.5. Remember, the higher your factor rate, the more money you have to pay back.

Most merchant cash advance services charge a holdback rate of between 10 and 20 percent. Choose a figure that you can live with. There might also be additional fees such as an origination fee or closing fee, so ensure that you understand everything you have to pay before you agree to the terms.

Cash Advance Term

This type of financing doesn’t have a set repayment period since how quickly you pay depends on your sales. Some lenders don’t have a set deadline to clear the advance. They simply continue to take a percentage of your sales for as long as it takes to clear the amount you owe.

Others, however, have set deadlines. You may incur additional fees by taking longer than the stipulated repayment time. This time can vary between four and 18 months. Make sure you know if there is a hard deadline before you agree to the financing.

As a general rule, consider your worst-case scenario before taking the advance. Many borrowers overshoot their sales projections when applying for funding, which can be a problem if you experience slow sales and a looming repayment deadline.

Repayment Structure

Most merchant cash advance repayments are daily, although a few vendors accept weekly payments. These are automatic credit card payments, so you may have to switch to a different card terminal provider that supports your financer.

ACH withdrawals may also be an option. Typical ACH repayments work with a fixed amount, where the lender takes the agreed figure every day or every week regardless of your sales.

Some ACH repayments also work with the variable repayment, where you are paying back a percentage of your sales. Make sure you clarify this with the cash advance service before you sign the contract.

Also, make sure that you are not getting penalized for paying early. In some cases, your APR may rise if you pay back the loan faster than expected.

Eligibility Requirements

For the most part, merchant cash advances are more accessible than traditional loans. Most lenders require a business bank account with a history of at least six months of transactions. Others may link with your accounting software, eliminating the need to file paperwork.

Other requirements may include:

- Minimum credit score – usually between 500 and 600

- Driver’s license

- Personal guarantee

- Certain number of monthly or annual sales or credit card transactions

- Business ID

- Recent tax returns

These requirements are not always mandatory. For example, some lenders do not check your credit score, especially if you have a high volume of transactions. Others may even work with you if you have filed for personal or business bankruptcy in the past.

However, merchant cash advances extended to high-risk clients tend to attract a high factor rate.

Minimum & Maximum Cash Advance

Finally, assess your business needs and figure out how much you need. A minimum cash advance can be between $1000 and $5000, while the maximum amount can be as high as $5 million, depending on the lender.

Also, check how long it takes to get approved and how long it takes for the money to hit your account. Many of these lenders process applications within hours or may take up to a few days. Similarly, it can take as little as one day or as long as five business days to receive the funds you qualify for.

Summary

The best advice you can get regarding merchant cash advances is to price shop. Watch out specifically for the factor rate and holdback rate to determine whether you are getting a good deal. If you have a good credit score and a long history of high-volume credit card transactions, you may qualify for traditional business loans, which will be much cheaper to pay back. Otherwise, merchant cash advances make more sense when you are in a bind and are not eligible for conventional loans.

Moreover, a merchant cash advance is more of a quick fix than a long-term solution to your businesses’ cash flow challenges. You will still need to solve the underlying issues if you hope to remain in business for a long time.

Use this guide to help you find the best merchant cash advance service for you and your business’s needs.

Source: https://www.quicksprout.com/feed